News Release

April 3, 2024

Minnesota’s uninsured rate hits all-time low despite coverage lapses, affordability concerns

New data released by the Minnesota Department of Health (MDH) today showed mixed results regarding health insurance coverage in the state during 2023. Minnesotans who went without care due to costs and those who expressed concerns about the financial protection of health insurance both increased, but the percentage of state residents without health care coverage remains low.

The data comes from the Minnesota Health Access Survey, a biennial state-based population survey that collects information on Minnesotans’ health insurance coverage and health care access. The survey measures how many people in Minnesota have health insurance and how easy it is for them to get health care.

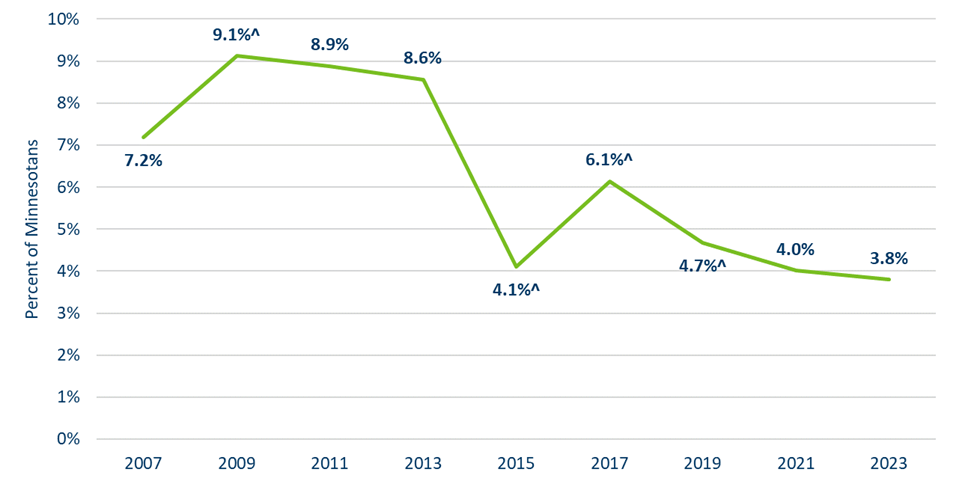

According to the data, the percent of Minnesotans without health insurance fell to 3.8% in 2023, an all-time low for the 22-year survey. Though the difference is not statistically significant from the previous survey, an estimated 11,000 fewer Minnesotans were uninsured in 2023 compared to 2021.

^ Indicates a statistically significant difference from previous year shown at p < 0.05.

Source: Minnesota Department of Health/Health Economics Program and University of Minnesota School of Public Health, Minnesota Health Access Survey, 2007-2023.

“We are encouraged by Minnesota’s overall uninsurance rate,” Minnesota Commissioner of Health Dr. Brooke Cunningham said. “However, we must keep in mind these rates are dynamic. The state must remain committed to ensuring that Minnesotans eligible for public coverage have it available to them and that those who are no longer eligible for public coverage have affordable private options. What we are seeing is that insurance and health care costs remain a barrier for many Minnesotans.”

Researchers concluded that the commitment made by the state to prevent eligible Minnesotans with Medical Assistance (MA) from losing coverage and becoming uninsured after the end of COVID-19 protections has thus far paid dividends in helping to keep the overall uninsurance rate low. They also acknowledge that these efforts should continue to prevent future coverage interruptions.

Another area where the state's uninsured rate showed improvement is in racial disparities among Hispanic Minnesotans, which fell from 21.4% in 2021 to 11.4% in 2023. But researchers note that only tells a part of the story. The data shows there is still work needed in this area to close the sizable gap in uninsurance rates between Minnesotans of color and American Indians (6.9% in 2023) and non-Hispanic white Minnesotans, which remained steady at 2.4%.

“Although Minnesota’s statewide uninsurance rate remains low, inequities persist,” said Kathleen Call, a professor with the University of Minnesota School of Public Health and an investigator at the State Health Access Data Assistance Center (SHADAC). “The data shows that uninsurance is experienced at much higher rates among Hispanic communities than among Minnesotans overall.”

Most uninsured Minnesotans experience long-term uninsurance, lacking insurance coverage for a year or longer. In 2023, however, they accounted for a smaller number of the uninsured and a smaller share, falling from 82.7% the year before to 74.5%. In contrast, the number of people with shorter gaps of insurance coverage increased in 2023, impacting approximately 16,000 more Minnesotans. The short-term uninsured accounted for 25.5% of all uninsured in 2023, up from 17.3% in 2021.

Half of the people experiencing short-term uninsurance in 2023 previously had group coverage, while 27.5% previously had public coverage. This is a stark contrast to 2021 when MA redeterminations were paused and 81.3% of those experiencing short-term uninsurance were previously enrolled in group coverage.

“The increase in prior public program coverage among the short-term uninsured may be an early warning sign that people no longer eligible for public program coverage are not successfully transitioning to other coverage as was hoped for,” said Stefan Gildemeister, Director of the Health Economics Program, the team that co-led this work.

Concerns over the financial protections provided by health insurance also edged higher in 2023. Minnesotans expressed increased anxiety about their ability to both cope with high deductibles and be protected from large medical bills by their insurance coverage. These cost concerns saw the rates of forgone care due to costs climb from 20.2% in 2021 to 24.5% in 2024, returning to pre-COVID-19 levels.

“Reports of forgone care due to costs between 2021 and 2023 increased for all Minnesotans,” said Kathleen Panas, the MDH project lead. “While increased cost burdens over the two-year period only reached significance for some groups of people, patterns of inequities persist.”

Lower income Minnesotans, Minnesotans of color and people with group coverage experienced the largest increases of forgone care according to the data, while uninsured Minnesotans had the highest rates.

“Reports of forgone care due to costs in 2023 are well above statewide rates among people in low-income households (under 200% of poverty) and Black, Indigenous and Hispanic people in Minnesota,” Call added. “It is discouraging that access to affordable health care remains out of reach for so many Minnesotans. This should not be acceptable.”

The Minnesota Health Access Survey (MNHA) is conducted as a partnership between MDH and SHADAC, which is part of the Health Policy and Management Division of the School of Public Health at the University of Minnesota, Twin Cities. The survey had responses from more the 15,000 Minnesotans across the state and was conducted between September 2023 and December 2023. More findings from the survey are available on the MDH Health Economics Program website.

-MDH-

Media inquiries:

Garry Bowman

MDH Communications

651-529-5164

garry.bowman@state.mn.us